Statutes of Limitations in Arizona Securities Cases

Statutes of Limitation in Arizona Securities Cases

Please note that, while this article accurately describes applicable law on the subject covered at the time of its writing, the law continues to develop with the passage of time. Accordingly, before relying upon this article, care should be taken to verify that the law described herein has not changed.

I. Statutes of Limitation, Generally.

The purpose of a statute of limitations is to protect defendants and courts from stale claims where plaintiffs have slept on their rights. Doe v. Roe, 191 Ariz. 313, 955 P.2d 951 (1998). Chapter 5 of Title 12 of the Arizona Revised Statutes sets out the general limitations provisions which govern most civil actions. 2 Ariz. Prac., Civil Trial Practice Sec. 14.3 (2d ed. 2005). Because a defense based upon the statute of limitations is generally disfavored, the longer of two periods is generally used if there is a question about which statute to apply. Id. A defendant who raises a statute of limitations defense has the burden of establishing that the claim is barred by the statute. Kiley v. Jennings, Strouss & Salmon,

187 Ariz. 136, 927 P.2d 796 (App. 1996). Once the defendant has made a prima facie showing that the plaintiff’s claim is untimely, the burden shifts to the plaintiff to establish that the “discovery rule” operates to delay commencement of the running of the statute, or that the running of the statute was otherwise tolled[1]. 2 Ariz. Prac., Civil Trial Practice Sec. 14.5 (2d ed. 2005). It should further be noted that under A.R.S Sec. 12-550, actions other than for recovery of real property for which no limitation is otherwise prescribed shall be brought within four years after the cause of action accrues, and not afterward.

Further, the one-year statute of limitations in A.R.S. Sec. 12-541(5) for liabilities created by statute applies only where a cause of action would not exist but for a statute. Andrews v. Eddie’s Place, 199 Ariz. 240, 16 P.3d 801 (App. 2000). If a tort cause of action and liability existed at common law, then the applicable statute of limitations is the two-year statute under A.R.S. Sec. 12-542(1), even if the cause of action has been codified in a statute. Id.

II. A.R.S. Sec. 44-1991 – Fraud in Purchase or Sale of Securities.

The statute of limitations for securities fraud claims provides that such a claim is barred “unless brought within two years after discovery of the fraudulent action on which the liability is based, or after the discovery should have been made by the exercise of reasonable diligence.” A.R.S. 44-2004(B). The only thing that needs to be discovered, to commence running of the limitations period for a securities fraud claim, is the fraudulent practice, and there is no requirement that the plaintiff discover he or she was damaged. Aaron v. Fromkin, 196 Ariz. 224, 994 P.2d 1039 (App. 2000); see also Wash. Nat’l Corp. v. Thomas,

117 Ariz. 95, 570 P.2d 1268 (App. 1977) (holding that a cause of action for alleged security violations and alleged misrepresentations, arising out of claimed unauthorized sale of trust beneficiary’s stock and purchase of mutual funds from proceeds, did not accrue until beneficiary’s stock was sold thus alerting his widow, rather than at time original trust agreements were executed and alleged misrepresentations made). Also possibly noteworthy, the 1977 amendment substituted “two years” for “one year” in subsection B, and deleted “and in no event shall such action be brought more than three years after the fraudulent practice occurred” at the end of the subsection, possibly showing intent in favor of enlarging, rather than diminishing, the statute of limitations in securities fraud period.

Additionally, Arizona also developed a “statute of repose” for securities fraud cases, which imposes a stricter deadline than the statute of limitations. The statute of repose begins to run from either the date of purchase or the date of the act or transaction constituting the violation and provides the outermost time in which an individual may bring a claim. If the individual fails to bring the claim within that time period, the claim is forever barred, regardless of the time of actual discovery, as the doctrine of equitable tolling does not apply to extend the time period. In Arizona, the statute of repose is five years and applies to claims for material misstatements or omissions in a prospectus or oral communication regarding the sale of the security. A.R.S. 44-2004(C).

III. Fraud, Deceit, Manipulation, or Contrivance Concerning the Federal Securities Laws.

The Sarbanes-Oxley Act of 2002 expanded the statutes of limitations and repose for federal securities fraud claims to the current two-year and five-year windows. The United States Code provides:

A private right of action that involves a claim of fraud, deceit, manipulation, or contrivance in contravention of a regulatory requirement concerning the securities laws . . . may be brought not later than the earlier of—

(1) 2 years after the discovery of the facts constituting the violation; or

(2) 5 years after such violation.

28 U.S.C. 1658(b)(1)-(2) (2002). Notably, for federal securities fraud claims, the statute of limitations begins to run when a reasonably diligent plaintiff would have discovered the underlying violations, and not from when a reasonably diligent plaintiff should have begun investigating the potential violations. Strategic Diversity, Inc. v. Alchemix Corp., 666 F.3d 1197, 1206 (9th Cir. 2012).

The Securities Act of 1933 contains similar statutes of limitation for rights of action arising from untrue statements and omissions. Actions alleging a violation of Section 11 for material omissions or misstatements in a registration statement must be brought within one year from the time of discovery of the untrue statement or omission, or from the time which such discovery should have been made by the exercise of reasonable diligence, and in no case more than three years after the security was first offered to the public. 15 U.S.C.A. § 77m. The same limitations apply to actions brought under Section 12(a)(2), which grants a private right of action for a material omission or misstatement in a prospectus. Id.

IV. A.R.S. Sec. 44-1522 – Consumer Fraud: Unlawful Practices; Intended Interpretation of Provisions.

A.R.S. Sec. 44-1522 (2005) provides, in pertinent part:

A. The act, use or employment by any person of any deception, deceptive act or practice, fraud, false pretense, false promise, misrepresentation, or concealment, suppression or omission of any material fact with intent that others rely upon such concealment, suppression or omission, in connection with the sale or advertisement of any merchandise whether or not any person has in fact been misled, deceived or damaged thereby, is declared to be an unlawful practice.

Case law reveals that an action commenced alleging liability created by the Consumer Fraud statute must be brought within one year. Murry v. W. Am. Mortg. Co., 124 Ariz. 387, 604 P.2d 651 (App. 1979); see also Alaface v. Nat’l Inv. Co., 181 Ariz. 586, 892 P.2d 1375 (App. 1994) (consumer fraud claim accrued when purchasers knew that real estate agent’s representations were not true and that they had been damaged by reliance on representations, and thus their claim was barred by one-year statute of limitations); London v. Green Acres Trust,

159 Ariz. 136, 765 P.2d 538 (App. 1988). However, note that in London v. Green Acres Trust,

159 Ariz. 136, 765 P.2d 538 (App. 1988), the one year statute of limitations was tolled by the defendants’ concealment of the facts that would have alerted plaintiffs to the fraud.

V. Common Law Fraud.

A.R.S. Sec. 12-543 provides, in pertinent part:

There shall be commenced and prosecuted within three years after the cause of action accrues, and not afterward, the following actions: [emphasis added]

3. For relief on the ground of fraud or mistake, which cause of action shall not be deemed to have accrued until the discovery by the aggrieved party of the facts constituting the fraud or mistake.

Consider also constructive fraud, wherein the running of the statute of limitations may be tolled where the plaintiff presents evidence that the defendant concealed the facts giving rise to the cause of action and thereby prevented the plaintiff from filing the claim in a timely manner. Walk v. Ring,

202 Ariz. 310, 44 P.3d 990 (2002); Mohave Elec. Coop., Inc. v. Byers, 189 Ariz. 292, 942 P.2d 451 (App. 1997). In addition, constructive fraud is sufficient to toll the running of the statute of limitations until the plaintiff either knows, or through the exercise of due diligence should have known, of the fraud. Lasley v. Helms,

179 Ariz. 589, 880 P.2d 1135 (App. 1994). Constructive fraud requires the existence of a confidential relationship, but does not require a showing of either intent to deceive or dishonesty of purpose. Id.

Further still, consider fraudulent concealment wherein the plaintiff is relieved of the duty of diligent investigation required by the discovery rule and the statute of limitations is tolled until the concealment is discovered. Walk v. Ring, 202 Ariz. 310, 44 P.3d 990 (2002).

VI. Common Law Negligence.

Negligence claims carry a two-year statute of limitation. A.R.S. Sec. 12-541-542; Sato v. Van Denburgh, 123 Ariz. 225, 599 P.2d 181 (1979); Hatch v. Reliance Ins. Co.,

758 F.2d 40 (9th Cir. 1985). Further, accrual of a negligence claim, for limitations purposes, requires not only negligence but also damage. Commercial Union Inc. Co. v. Lewis & Roca,

183 Ariz. 250, 902 P.2d 1354 (App. 1995); Owens v. City of Phx., 180 Ariz. 402, 884 P.2d 1100 (App. 1994).

VII. Breach of Fiduciary Duty.

A.R.S. Sec. 12-542 indicates that there shall be commenced and prosecuted within two years after the cause of action accrues, and not afterward. Case law interprets breach of fiduciary duty claims to fall under the purview of A.R.S. Sec. 12-542 and requires actual or constructive knowledge of damages. See Mohave Elec. Co-op, Inc. v. Byers, 189 Ariz. 292, 942 P.2d 451 (App. 1997) (holding that for notice to be sufficient to begin statute of limitations, plaintiff must have knowledge of both what and who caused its damage; further, wrongful concealment typically tolls the statute of limitation); CDT, Inc. v. Addison, Roberts & Ludwig, C.P.A., P.C.,

198 Ariz. 173, 7 P.3d 979 (App. 2000) (holding that the two-year statute of limitations applies to actions for, among others, breach of fiduciary duty, and requires notice of actual or constructive damages).

VIII. Breach of Oral Contract.

The right to sue for breach of a verbal/oral contract is subject to the three-year statute of limitations provided for in A.R.S. Sec. 12-543 and requires damages. Kain v. Ariz. Copper Co.,

14 Ariz. 566, 133 P. 412 (1913); Kersten v. Continental Bank, 129 Ariz. 44, 628 P.2d 592 (App. 1981).

IX. Breach of Written Contract.

The applicable statute of limitations for actions of written contracts is six years for contracts executed within Arizona [and four years for contracts executed outside the state]. A.R.S Sec.Sec. 12-548, 12-544(3)[2]. Further, the Arizona Supreme Court held that the “discovery rule” should be applied to contract actions. Gust Rosenfeld & Henderson v. Prudential Insurance Co. of America,

182 Ariz. 586, 898 P.2d 964 (1995). In contract actions, as in tort actions, the statute of limitations will not commence to run until the plaintiff knows or in the exercise of reasonable diligence should have known that it has suffered injury as a consequence of a breach of contract[3]. Id.

While the statutory limitations period for actions arising out of a written contract is six years, clauses in contracts which specify when an action under the contract must be brought are enforceable, even if they specify an earlier date. Decca Design Build, Inc. v. American Automobile Insurance Company, 206 Ariz. 301, 77 P.3d 1251 (App. 2003).

X. Negligent Misrepresentation.

The statute of limitations for a claim of negligent misrepresentation is the two-year statute set forth in A.R.S. Sec. 12-542. See also, Hullett v. Cousin,

204 Ariz. 292, 63 P.3d 1029 (2003).

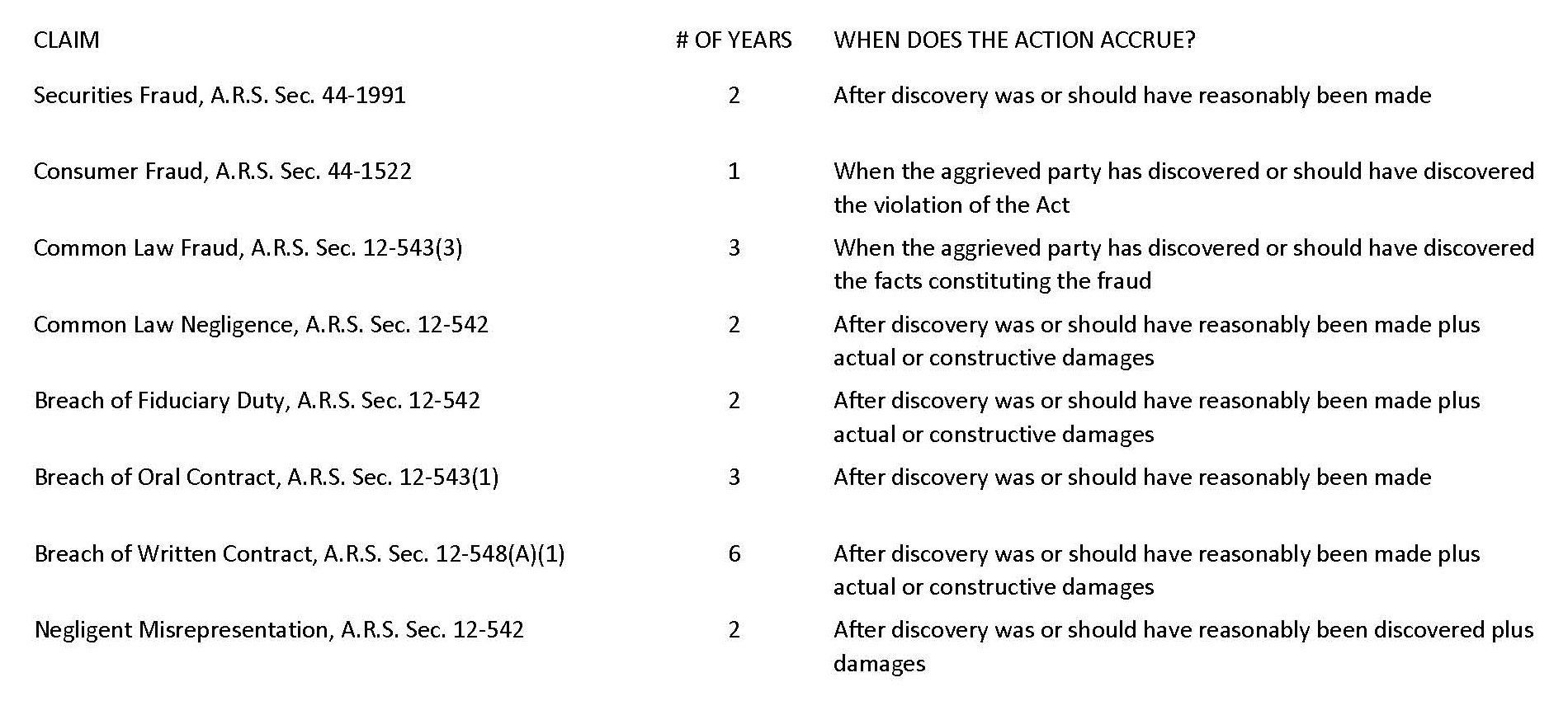

Statute of Limitations: Quick Reference Table

[1] The “discovery rule” requires only the discovery of the facts which give rise to a cause of action rather than discovery of the legal significance of those facts. Doe v. Roe, 191 Ariz. 313, 955 P.2d 951 (1998). For the statute to commence to run, it is not necessary that the claimant know all the facts; all that is required is that the claimant know enough facts as would prompt a reasonable person to investigate and discover the full extent of the claim. Id. Under the discovery rule, for the statute of limitations to commence to run, the plaintiff must have also sustained actual, appreciable and non-speculative damages, rather than the threat of future harm. CDT, Inc. v. Addison, Roberts & Ludwig, C.P.A., P.C.,

198 Ariz. 173, 7 P.3d 979 (App. 2000).

[2] An action for negligent performance of a contract, which sounds exclusively in tort, is not one “based on a contract” for purposes of determining the appropriate statute of limitations to apply. Fry’s Food Stores v. Mather & Assocs., Inc.,

183 Ariz. 89, 900 P.2d 1225 (App. 1995).

[3] Note, however, that an action for negligent performance of a contract, which sounds exclusively in tort, is not one “based on a contract” for purposes of determining the appropriate statute of limitations to apply. Id.

© 2024

All Rights Reserved | Robert D. Mitchell

The act of visiting or communicating with the attorneys featured in this website by email or other medium does not constitute an attorney-client relationship. Communications from non-clients are not subject to client confidentiality or attorney-client privilege. Further, the articles, discussion, commentary, forms and sample documentation contained in this website are offered as general guidance only and are not to be relied upon as specific legal advice. For legal advice on a specific matter, please consult with an attorney who is knowledgeable and experienced in that area. The lawyers listed in this website practice law only in the jurisdictions where they are admitted.

For information on other practice areas at Tiffany and Bosco, P.A., please visit Practice Areas. For information on the other attorneys of Tiffany & Bosco, P.A., please visit Find an Attorney.